Typical valuation frameworks don’t apply to gold. Without a coupon or dividend, discounted cash flow models can’t be built. There are no expected earnings or book-to-value ratios either. Conceptually, four drivers explain fluctuations in gold prices (figure 1). First, periods of economic growth tend to raise gold demand for jewellery, technology and savings. Second, bouts of uncertainty often boost demand for gold as a safe-haven investment, for diversification and hedging. Third, the opportunity cost of holding competing assets is a key determinant. Fourth, capital flows and positioning have an impact too, by amplifying or dampening the momentum in gold prices.

Letting the data speak

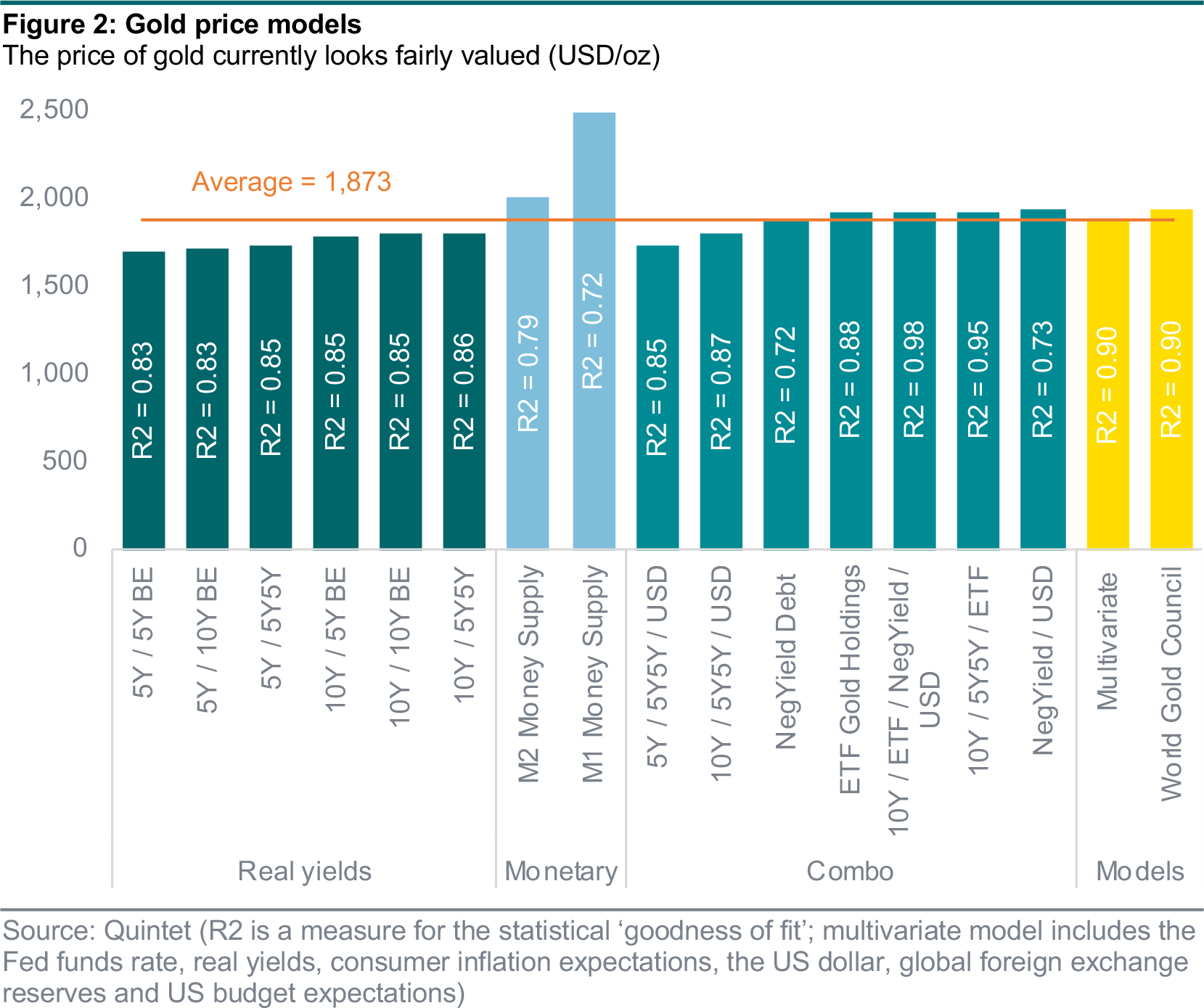

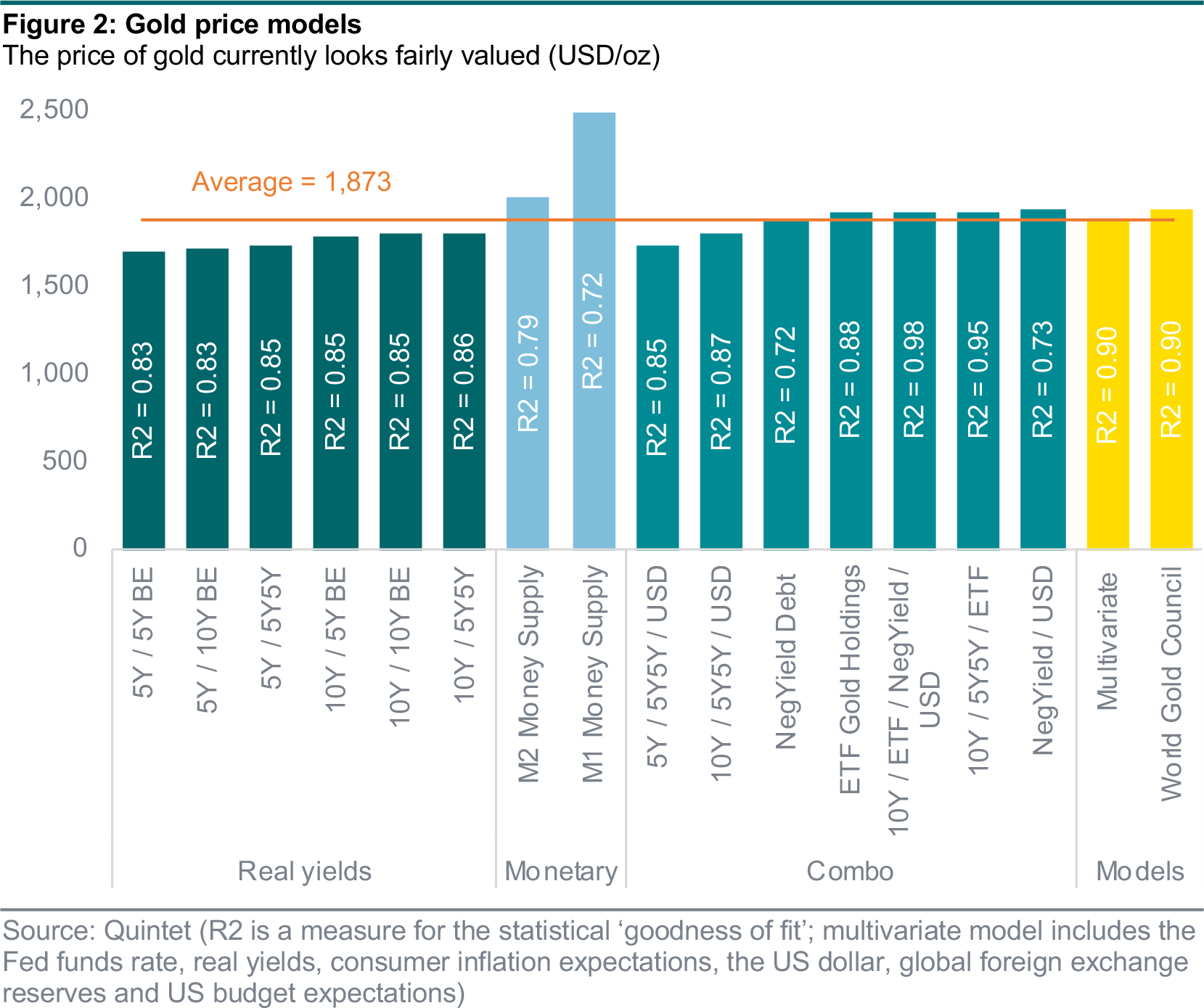

The different gold drivers aren’t equally important. And their relative impact on gold prices varies over time. So we run statistical tests to establish how well they perform as explanatory variables – one by one, in pairs, three at a time and so on, mostly as single equations but also using the econometric model developed by the World Gold Council (figure 2). We then calculate a weighted average for the price of gold that all these statistical models would imply, with the weights representing how well they fit the data. We find that the average price these models imply is around 1,870 $/oz, close to current levels (excluding the highest/lowest estimate, the average is around 1,850 $/oz).

The models based on money supply project gold prices as high as between 2,000 and 2,500 $/oz but, taken on their own, they perform less well. Those based on real yields point to a range of 1,700-1,800 $/oz, and tend to perform better. The best statistical relationship we could find includes gold ETF holdings, both on their own and, especially, when combined with real yields, the US dollar and negative yielding debt. We also test many other variables, such as global foreign exchange reserves and US budget expectations, which improve the robustness of the statistical relationship when combined with real yields, but are difficult to project into the future.

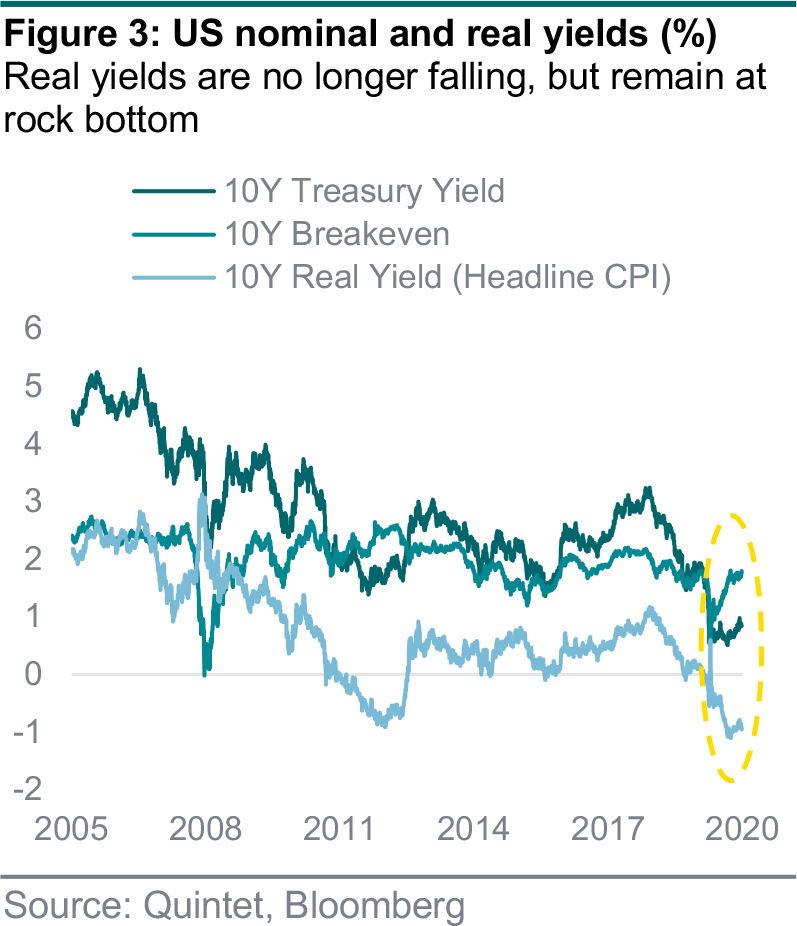

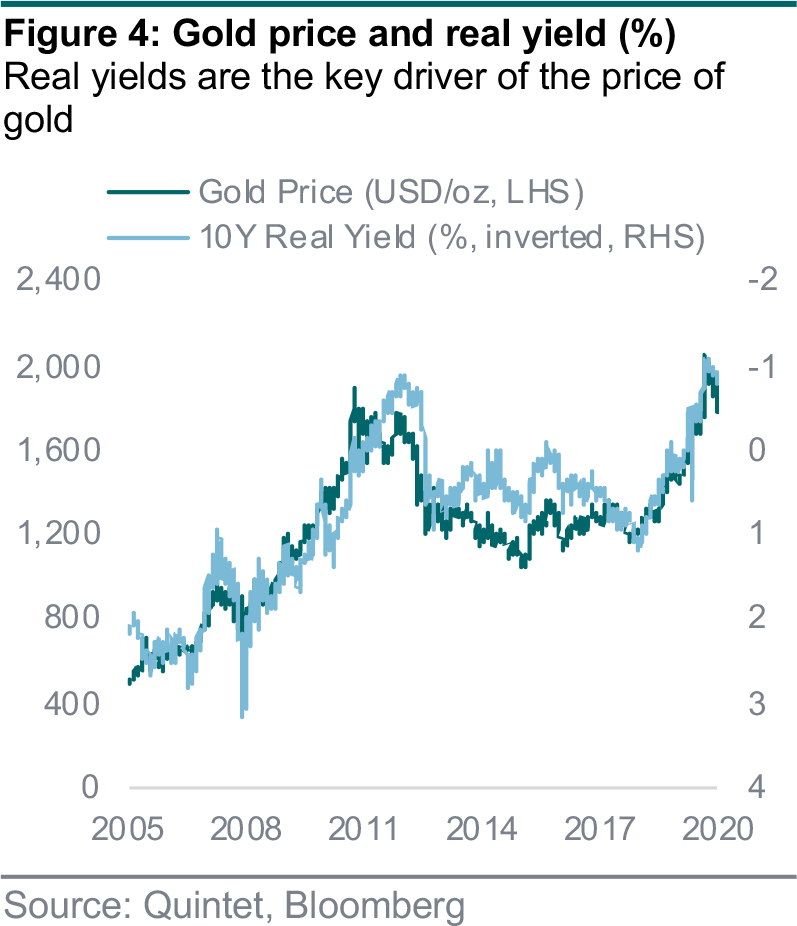

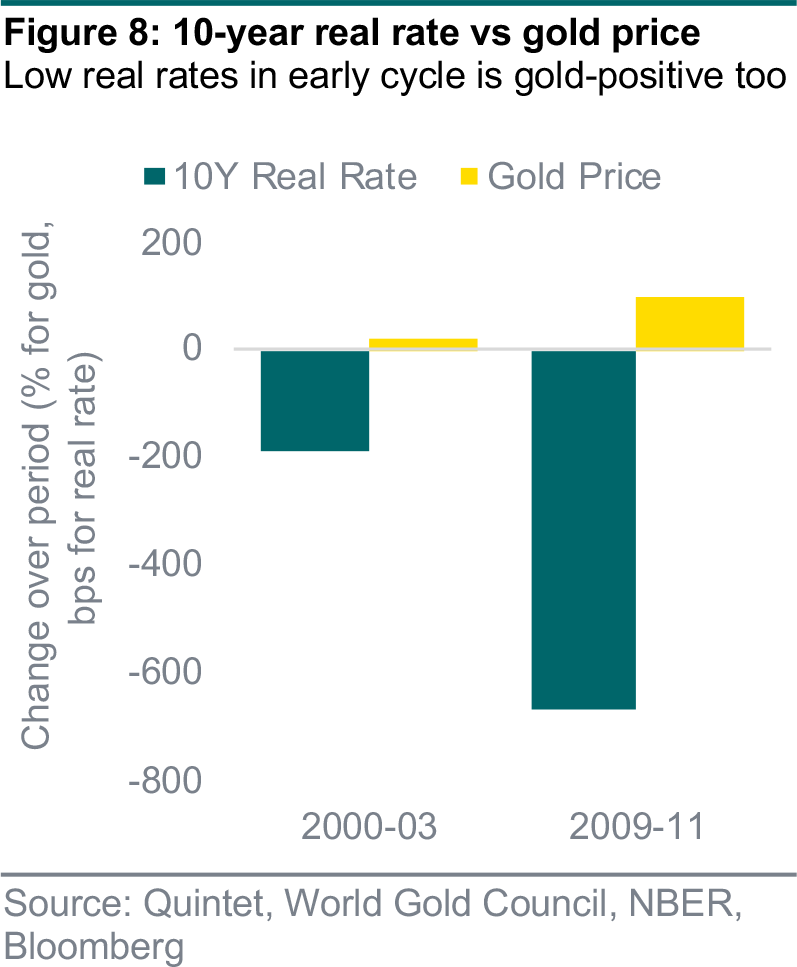

The importance of real yields is twofold. First, we find that their relationship with gold prices is stable over long timeframes. Second, they’re part of the standard set of market variables we monitor and attempt to forecast. Lower real yields of US government bonds increase the relative attractiveness of near-substitutes, such as gold. As economic uncertainty fades, demand for safe-haven assets including gold should fall. But this is only likely to take a little shine off gold prices, as low real yields are a key support. Importantly, though, we don’t expect real yields to fall further from here, as central banks are likely to mitigate any rise in nominal yields, while inflation expectations should rise gradually. This should limit any potential upside to gold prices from here (figures 3 and 4).