A knee-jerk reaction from markets to the latest flareup in Middle Eastern tensions

In the latest tit-for-tat exchange, Israel struck Iran last Friday in response to Iran’s strike on Israel the previous week. It’s possible that Israel’s limited response could end the round of direct clashes between the two countries, at least for the time being, given that both countries have described their actions as a specific operation in response to the actions from the other (the very definition of tit-for-tat), rather than as an attempt to escalate more generally. However, it’s also possible that we’ll see higher and protracted geopolitical uncertainty in the Middle East, with unpredictable bouts of escalation that could spur market volatility. These events sent shares lower and safe-haven assets such as government bonds, gold, the Swiss franc, and the Japanese yen higher. Oil also went higher. Eventually, these knee-jerk reactions quicky started to reverse, albeit not fully. Oil prices, for instance, fell close to where they were before the incident, closing the week 3.5% lower.

Aligning portfolios to a fragmented world

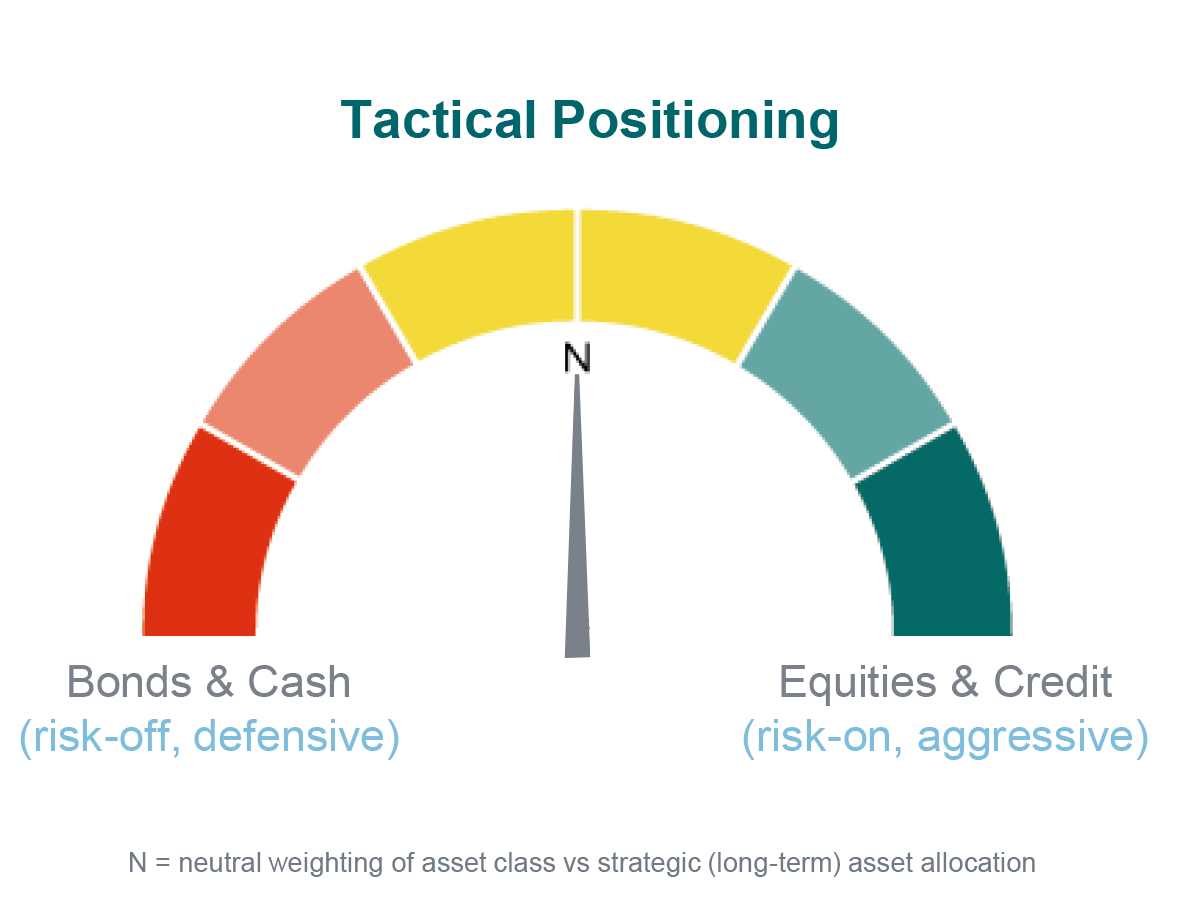

One of our central themes for 2024 and beyond is a more ‘fragmented world’ along geopolitical lines. The thesis is that geopolitical actors with contrasting goals can spur market volatility. At the end of 2023, we bought assets that could protect from geopolitical risks (and also inflation risks), such as commodities, which we added strategically on top of our long-standing gold exposure. More recently, just before the start of the latest bout of Middle Eastern tensions, we’ve bought an ‘insurance’ instrument that appreciates when equities are falling, partially protecting portfolios when this happens. This instrument, so far, is performing well, just like we expected. Of course, we continue to monitor the situation closely, continue to run a well-diversified, multi-asset strategy that aims to mitigate the impact of local events by gaining exposure to regions and asset classes that are driven by different factors and, where we perceive some vulnerability, such as European equities, we own fewer equities in that region relative to our long-term allocation.

Economic data still the main driver of markets

Bond yields rose over the course of the week as US economic data, such as retail sales, continued to point to a strong economy. Because of this, US Federal Reserve (Fed) Chair, Jerome Powell, said that interest rates could remain where they are now for longer (5.25-5.5%). This weighed on equities as markets moderated their expectations for interest rates cuts, resulting in some profit-taking after US equity indices had risen around 10% in 2024, and despite a rather good start to the earnings season. The S&P 500 and Nasdaq equity indices closed the week 3% and 5% lower respectively, and the pan European Stoxx 600 equity index fell 1.2%. This week, the economic outlook should return to the forefront and drive markets. GDP growth for the first quarter will likely and unsurprisingly confirm the strength of the US economy (Thursday). However, the market’s attention will focus on the release of the personal consumption expenditure index (the Fed’s preferred measure of inflation) on Friday, considering the recent comments made by Chair Powell. In Europe, the purchasing managers’ indices and other leading indicators such as the German Ifo business climate, throughout the week, are likely to confirm the gradual recovery of the economy, Europe, however, remains relatively weak.